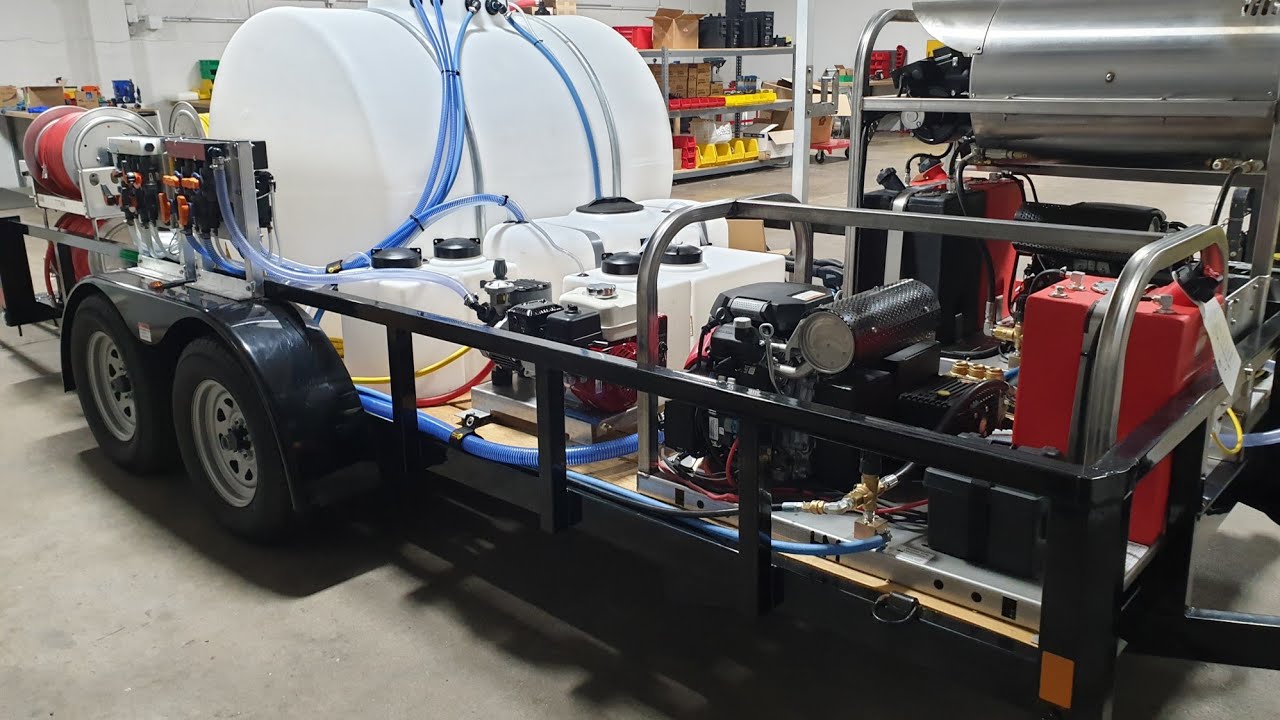

One of the biggest decisions you’ll face as a power washing business owner is how to acquire your equipment. From commercial-grade pressure washers to soft wash systems, trailers, tanks, and surface cleaners—it all adds up. Fast. 💰

So should you buy your gear outright or consider leasing it? 🤔

There’s no one-size-fits-all answer. The right choice depends on your goals, cash flow, and business stage. In this article, we’ll break down the pros and cons of leasing vs. buying your power washing equipment so you can make the smartest move for your business. 🧠💦

💳 Option 1: Buying Your Equipment Outright

Buying equipment means you pay for it in full upfront (or with a loan) and own it immediately.

✅ Pros of Buying:

- Full ownership – You own the asset outright

- No recurring monthly payments

- More customization – You can modify or resell at will

- Better long-term ROI – Once paid off, there’s no cost

- Tax deductions – Equipment purchases are often 100% deductible (Section 179)

❌ Cons of Buying:

- Big upfront cost – Could drain cash flow

- Maintenance is on you – Repairs and servicing are your responsibility

- Depreciation – Equipment loses value over time

- Harder to upgrade – You’re stuck with what you bought unless you resell

🧽 Example: A high-end hot water pressure washer may cost $5,000–$8,000. Add hoses, reels, surface cleaners, and tanks, and you’re easily looking at $10K–$15K just to get started.

If you have strong cash reserves or financing, buying can be the most cost-effective option in the long run. 💪

Browse Amazon Here For Top Rated Power Washers And Accessories

📄 Option 2: Leasing Your Equipment

Leasing allows you to use the equipment without owning it by making monthly payments to a lender or vendor for a set period—usually 24 to 60 months.

✅ Pros of Leasing:

- Lower upfront cost – Keep cash in your business

- Predictable monthly payments – Great for budgeting

- Easier to upgrade – Swap for newer gear when lease ends

- May include maintenance or warranties

- Preserves credit lines – Doesn’t tie up working capital

❌ Cons of Leasing:

- You don’t own the equipment

- Higher total cost over time

- Early termination fees may apply

- Usage limits or terms could restrict flexibility

🧾 Some leases end with a buyout option, letting you purchase the equipment for a small fee at the end. Others are “return only” agreements.

💡 When Leasing Makes Sense

Leasing might be right for your power washing business if:

✅ You’re just starting out and want to stay cash-light

✅ You want to test new equipment before committing

✅ You prefer to upgrade every few years

✅ You’re focused on preserving working capital

✅ You need to scale fast with multiple rigs

Some vendors even offer lease-to-own programs with zero down and flexible buyouts—perfect for solopreneurs or fast-growing crews. 🔄

💸 Comparing the Numbers: Lease vs. Buy

Let’s look at a simplified example:

Buying Scenario:

- Equipment package: $12,000

- Maintenance: $500/year

- Tax deduction: $12,000 via Section 179

- Resale value after 5 years: $3,000

- Total 5-year cost: ~$9,500

Leasing Scenario:

- Lease term: 5 years

- Monthly payment: $300

- Total paid over term: $18,000

- No resale value or ownership

- Total 5-year cost: $18,000

🧠 The lease costs more—but protects cash flow and gives flexibility. If you’re generating $10K/month, that $12K upfront might be better spent on marketing, payroll, or additional contracts.

🔧 What About Maintenance?

When you buy, you’re responsible for all upkeep. That includes:

- Engine servicing

- Hose replacements

- Pump oil changes

- Burner tune-ups

- Repairs and replacements

Leases may include maintenance packages, especially from equipment dealers. These can reduce downtime and remove the repair headaches—at a cost.

📋 Tips for Leasing Equipment the Smart Way

If you decide to lease, follow these tips:

✅ Compare multiple lenders (not just the one your dealer offers)

✅ Look for early buyout options or lease-to-own plans

✅ Understand interest rates and total cost

✅ Ask about equipment insurance requirements

✅ Read the fine print: hidden fees, penalties, usage caps

Don’t jump at the first offer. Leasing contracts are negotiable, especially if you have a good credit score or business history.

🧾 Tax Implications: Lease vs. Buy

In many cases, both lease payments and equipment purchases are tax-deductible—but the deduction structure differs.

- Purchased equipment: Use Section 179 to deduct 100% in year one (up to IRS limits)

- Leased equipment: Monthly payments may be deducted as an operating expense

Consult with a tax advisor to determine which method yields the most savings based on your income and expenses. 📊

🔄 Hybrid Option: Buy Some, Lease Some

Many growing power washing businesses use a hybrid strategy:

🛠️ Buy foundational equipment (trailer, basic pressure washer)

🧰 Lease expensive or upgradeable gear (hot water skid, vacuum systems)

This gives you ownership where it matters, and flexibility where you need it. 🧠⚖️

💬 Final Thoughts

So, should you lease or buy your power washing equipment?

👉 If you have the cash and plan to keep the gear long-term: Buy

👉 If you’re focused on growth, flexibility, and cash flow: Lease

👉 If you want the best of both worlds: Do both

What matters most is that your equipment helps you generate reliable revenue without putting your business at risk.

Because at the end of the day, it’s not just about gear—it’s about what that gear helps you build. 💪🧼🚐

Browse Amazon Here For Top Rated Power Washers And Accessories